Therefore, It’s Constitutionally Prohibited

NOT SO FAST: OBAMACARE “TAX” IS UN-APPORTIONED

Editor’s Note: Of all the mandates in the Constitution, there is only one that is repeated twice: direct taxes must be apportioned. Judge Roberts has admitted this. Writing for the majority in the Supreme Court’s decision on Obamacare, Roberts confessed direct taxes “must be apportioned among the states.” To avoid this constitutional restraint, Roberts falsely declared Obamacare’s individual mandate is not a tax on the ownership of personal property and “is thus not a direct tax that must be apportioned among the several states.” The decision is erroneous. Most troubling is the fact that both the majority and the dissent refused to deal honestly with the issue of direct taxes.

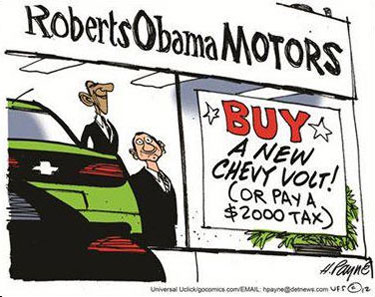

On June 28, 2012, five of the nine Justices of the Supreme Court upheld the most controversial provision of the Patient Protection and Affordable Care Act (“Obamacare”): Section 5000A, popularly known as the “individual mandate.” Right-click to download the decision.

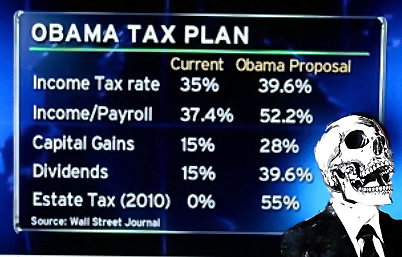

Under 5000A, those who can afford to but do not purchase health insurance will be required to make an additional payment to IRS for each month they go without the insurance. The payment will be exacted from the worker’s income and will be legally unavoidable. Justice Roberts wrote:

“Under the mandate, if an individual does not maintain health insurance, the only consequence is that he must make an additional payment to the IRS when he pays his taxes. See §5000A(b).”

The Obama administration argued in Court that what it called the “shared responsibility payment” was authorized under the Commerce Clause.

Judge Roberts ruled the Commerce Clause does NOT authorize this type of payment. However, Chief Justice Roberts then held Congress had the power under the “Tax Clause” to exact the payment.

We sharply disagree and here challenge the logic of the Court’s decision that Congress has the power under the Tax Clause to require the People to buy a product or pay a tax to the Government for not purchasing the product,without apportioning the tax among the several states.

Congress’s taxing power is specified in three sections of Article I:

Article I, Section 2, Clause 3:

“Representatives and direct taxes shall be apportioned among the several states which may be included within this Union ….”

Article I, Section 8, Clause 1:

“The Congress shall have power to lay and collect taxes, duties, imposts and excises… but all duties, imposts and excises shall be uniform throughout the United States.”

Article I, Section 9, Clause 4:

“No capitation, or other direct, tax shall be laid, unless in proportion to the census or enumeration herein before directed to be taken.”

Of all the mandates in the Constitution, there is only one that is repeated twice: direct taxes must be apportioned. It means exactly what it says.

By these three clauses, the People and the States grant Congress the power to impose two types of taxes, Direct and Indirect, but under strictly limited conditions:

1) Direct Taxes, identified as “Capitation and other direct taxes,” are taxes which, if imposed by Congress, must be equally apportioned among the People according to the last census. For example, if the Congress decided to exact a certain amount of money by imposing a Direct tax (a tax the People cannot legally avoid) and California has 13% of the Union’s representation based on population as ascertained by the census, then California must raise 13% of the total amount of the Direct Tax imposed by Congress, and;

2) Indirect Taxes, identified as “Duties, Imposts and Excises,” which, if imposed by Congress, must beuniform throughout the United States. For example, if Congress decided to exact money by imposing a Duty, Impost or Excise (a tax to be paid on the exportation, importation or purchase/consumption of a good), the amount of the tax must be the same no matter the point of importation, exportation or sale. Not being “Direct,” apportioned and unavoidable, these “Indirect” taxes are uniform and importantly, legally avoidable.

Roberts, on page 32 of his Opinion, held the individual mandate to be a tax. Quoting:

Under the mandate, if an individual does not maintain health insurance, the only consequence is that he must make an additional payment to the IRS when he pays his taxes. See §5000A(b). That, according to the Government, means the mandate can be regarded as establishing a condition—not owning health insurance—that triggers a tax—the required payment to the IRS. Under that theory, the mandate is not a legal command to buy insurance. Rather, it makes going without insurance just another thing the Government taxes, like buying gasoline or earning income. And if the mandate is in effect just a tax hike on certain taxpayers who do not have health insurance, it may be within Congress’s constitutional power to tax.

The question is not whether that is the most natural interpretation of the mandate, but only whether it is a “fairly possible” one. Crowell v. Benson, 285 U. S. 22, 62 (1932). As we have explained, “every reasonable construction must be resorted to, in order to save a statute from unconstitutionality.” Hooper v. California, 155 U. S. 648, 657 (1895). The Government asks us to interpret the mandate as imposing a tax, if it would otherwise violate the Constitution. Granting the Act the full measure of deference owed to federal statutes, it can be so read, for the reasons set forth below.

Roberts, on page 39 wrote:

Our precedent demonstrates that Congress had the power to impose the exaction in §5000A under the taxing power, and that §5000A need not be read to do more than impose a tax. That is sufficient to sustain it.

Roberts, on page 41, held the tax is “not a direct tax that must be apportioned.” Quoting:

A tax on going without health insurance does not fall within any recognized category of direct tax. It is not a capitation… The payment is also plainly not a tax on the ownership of land or personal property. The shared responsibility payment is thus not a direct tax that must be apportioned among the several States.

NOT SO FAST. The shared responsibility payment is a tax on personal property and therefore must be apportioned among the states.

The purpose of an act must be found in its natural operation and effect. In this case the tax under Section 5000A is a compulsory contribution to government revenue, levied by the government on workers’ income. A worker’s income, the fruits of his labor, is his personal property.

Roberts, on page 33, describes how the payment will be exacted from income. Quoting:

The “[s]hared responsibility payment,” as the statute entitles it, is paid into the Treasury by “taxpayer[s]” when they file their tax returns. 26 U. S. C. §5000A(b). It does not apply to individuals who do not pay federal income taxes because their household income is less than the filing threshold in the Internal Revenue Code. §5000A(e)(2). For taxpayers who do owe the payment, its amount is determined by such familiar factors as taxable income, number of dependents, and joint filing status. §§5000A(b)(3), (c)(2), (c)(4). The requirement to pay is found in the Internal Revenue Code and enforced by the IRS, which—as we previously explained—must assess and collect it “in the same manner as taxes.” Supra, at 13–14. This process yields the essential feature of any tax: it produces at least some revenue for the Government. United States v. Kahriger, 345 U. S. 22, 28, n. 4 (1953). Indeed, the payment is expected to raise about $4 billion per year by 2017.

A worker’s income is indeed his personal property. The source of any worker’s income is his labor. Both his labor and the fruits of his labor (his income) are his personal property, long held to be a natural Right.

John Locke, in his Second Treatise on Government, argued in support of individual property rights as “natural rights”. Following the argument the fruits of one’s labor are one’s own because one worked for it.

That a worker’s labor is personal property falling within the zone of interests to be protected by the Constitution has been affirmed many times by the Supreme Court.

In 1884, the Supreme Court had this to say in Butchers’ Union Slaughter-House and Live-Stock Landing Company v. Crescent City Live-Stock Landing and Slaughter-House Company, 111 U.S. 746. The Opinion was written by Justice Miller. A concurring opinion by Justices Field and Bradley read in part:

As in our intercourse with our fellow-men certain principles of morality are assumed to exist, without which society would be impossible, so certain inherent rights lie at the foundation of all action, and upon a recognition of them alone can free institutions be maintained. These inherent rights have never been more happily expressed than in the Declaration of Independence, that new evangel of liberty to the people: “We hold these truths to be self-evident” — that is so plain that their truth is recognized upon their mere statement — “that all men are [*757] endowed” — not by edicts of Emperors, or decrees of Parliament, or acts of Congress, but “by their Creator with certain inalienable rights” — that is, rights which cannot be bartered away, or given away, or taken away except in punishment of crime — “and that among these are life, liberty, and the pursuit of happiness, and to secure these” — not grant them but secure them — “governments are instituted among men, deriving their just powers from the consent of the governed.”

Among these inalienable rights, as proclaimed in that great document, is the right of men to pursue their happiness, by which is meant the right to pursue any lawful business or vocation, in any manner not inconsistent with the equal rights of others, which may increase their prosperity or develop their faculties, so as to give to them their highest enjoyment.

The common business and callings of life, the ordinary trades and pursuits, which are innocuous in themselves, and have been followed in all communities from time immemorial, must, therefore, be free in this country to all alike upon the same conditions. The right to pursue them, without let or hindrance, except that which is applied to all persons of the same age, sex, and condition, is a distinguishing privilege of citizens of the United States, and an essential element of that freedom which they claim as their birthright.

It has been well said that, “The property which every man has is his own labor, as it is the original foundation of all other property, so it is the most sacred and inviolable. The patrimony of the poor man lies in the strength and dexterity of his own hands, and to hinder his employing this strength and dexterity in what manner he thinks proper, without injury to his neighbor, is a plain violation of this most sacred property. It is a manifest encroachment upon the just liberty both of the workman and of those who might be disposed to employ him. As it hinders the one from working at what he thinks proper, so it hinders the others from employing whom they think proper.” Adam Smith’s Wealth of Nations, Bk. I. Chap. 10. (emphasis added).

In 1915, in Coppage v. Kansas, 236 U.S. 1 at 14, the Supreme Court again declared a worker’s labor as his personal property, and well within the zone of interest protected by the Constitution.

The principle is fundamental and vital. Included in the right of personal liberty and the right of private property — partaking of the nature of each — is the right to make contracts for the acquisition of property. Chief among such contracts is that of personal employment, by which labor and other services are exchanged for money or other forms of property. If this right be struck down or arbitrarily interfered with, there is a substantial impairment of liberty in the long-established constitutional sense. The right is as essential to the laborer as to the capitalist, to the poor as to the rich; for the vast majority of persons have no other honest way to begin to acquire property, save by working for money.

An interference with this liberty…so disturbing of equality of right, must be deemed to be arbitrary, unless it be supportable as a reasonable exercise of the police power of the State.

In 1915, in Truax v. Raich 239 U.S. at 41, the Supreme Court held:

The right to work for a living in the common occupations of the community is of the very essence of the personal freedom and opportunity that it was the purpose of the Fourteenth Amendment to secure.

Roberts, on page 41, admits, “it should be troubling to permit Congress to impose a tax for not doing something.” Quoting:

“There may, however, be a more fundamental objection to a tax on those who lack health insurance. Even if only a tax, the payment under §5000A(b) remains a burden that the Federal Government imposes for an omission, not an act. If it is troubling to interpret the Commerce Clause as authorizing Congress to regulate those who abstain from commerce, perhaps it should be similarly troubling to permit Congress to impose a tax for not doing something.”

Roberts then attempts to repress this concern. Quoting:

Three considerations allay this concern.

First, and most importantly, it is abundantly clear the Constitution does not guarantee that individuals may avoid taxation through inactivity. A capitation, after all, is a tax that everyone must pay simply for existing, and capitations are expressly contemplated by the Constitution. The Court today holds that our Constitution protects us from federal regulation under the Commerce Clause so long as we abstain from the regulated activity. But from its creation, the Constitution has made no such promise with respect to taxes.

NOT SO FAST. In fact, We the People are protected from federal taxation so long as we abstain from engaging in importation, exportation and consumption of those goods taxed uniformly and from owning real and personal property taxed in proportion to representation based on population as ascertained by the census (see definition of “Indirect and “Direct” Taxes, above).

Roberts continued his attempt to alleviate concern over upholding a tax on income for not doing something. Quoting:

Whether the mandate can be upheld under the Commerce Clause is a question about the scope of federal authority. Its answer depends on whether Congress can exercise what all acknowledge to be the novel course of directing individuals to purchase insurance. Congress’s use of the Taxing Clause to encourage buying something is, by contrast, not new. Tax incentives already promote, for example, purchasing homes and professional educations. See 26 U. S. C. §§163(h), 25A. Sustaining the mandate as a tax depends only on whether Congress has properly exercised its taxing power to encourage purchasing health insurance, not whether it can. Upholding the individual mandate under the Taxing Clause thus does not recognize any new federal power. It determines that Congress has used an existing one.

NOT SO FAST. There is a sharp difference between:

a) existing tax incentives (credits) designed to coax People into purchasing a product (i.e., a home, professional education or energy-efficient windows) by reducing one’s income taxes if they make the purchase, and

b) mandating and forcing people to purchase a product by increasing their income taxes if they chose not to purchase the product.

In addition, whether the tax adds to income or detracts from income is of no consequence, the object and effect of the tax is still the fruits of the worker’s labor, his income, I.E., his personal property. If the tax is directed at personal property it must be apportioned. Roberts said so when he wrote, “The payment is also plainly not a tax on the ownership of land or personal property. The shared responsibility payment is thus not a direct tax that must be apportioned among the several States.”

Roberts continued his attempt to quiet concern over increasing a worker’s income tax for not buying a product the Government wants you to purchase. Quoting:

Second, Congress’s ability to use its taxing power to influence conduct is not without limits. A few of our cases policed these limits aggressively, invalidating punitive exactions obviously designed to regulate behavior otherwise regarded at the time as beyond federal authority. See, e.g., United Statesv. Butler, 297 U. S. 1 (1936); Drexel Furniture, 259 U. S. 20. Page ___

More often and more recently we have declined to closely examine the regulatory motive or effect of revenue-raising measures. See Kahriger, 345 U. S., at 27–31 (collecting cases). We have nonetheless maintained that “‘there comes a time in the extension of the penalizing features of the so-called tax when it loses its character as such and becomes a mere penalty with the characteristics of regulation and punishment.’” Kurth Ranch, 511 U. S., at 779 (quoting Drexel Furniture, supra, at 38).

Texas Blocks Obama/Robert’s ‘Commerce Clause Tax’ Care: Both Are Unconstitutional & Unacceptable ~ Obama Withdraws $6.6 Billion For AIDS/HIV Care!

We have already explained that the shared responsibility payment’s practical characteristics pass muster as a tax under our narrowest interpretations of the taxing power. Supra, at 35–36. Because the tax at hand is within even those strict limits, we need not here decide the precise point at which an exaction becomes so punitive that the taxing power does not authorize it. It remains true, however, that the “‘power to tax is not the power to destroy while this Court sits.’” Oklahoma Tax Comm’n v.Texas Co., 336 U. S. 342, 364 (1949) (quoting Panhandle Oil Co. v. Mississippi ex rel. Knox, 277 U. S. 218, 223 (1928) (Holmes, J., dissenting)).

NOT SO FAST. The individual mandate does not pass constitutional muster, as shown herein, and therefore SHOULD NOT BE TOLERATED. We the People and the States should never trust that any of the three branches of the federal government will be guided by the Constitution in all that they do. The Justices of the Supreme Court often disagree with one another for political or ideological reasons or otherwise. Sometimes the Court overrules its earlier decision(s).

Robert continued his attempt to relieve concern over his ruling. Quoting:

Third, although the breadth of Congress’s power to tax is greater than its power to regulate commerce, the taxing power does not give Congress the same degree of control over individual behavior. Once we recognize that Congress may regulate a particular decision under the Commerce Clause, the Federal Government can bring its full weight to bear. Congress may simply command individuals to do as it directs. An individual who disobeys may be subjected to criminal sanctions.

Those sanctions can include not only fines and imprisonment, but all the attendant consequences of being branded a criminal: deprivation of otherwise protected civil rights, such as the right to bear arms or vote in elections; loss of employment opportunities; social stigma; and severe disabilities in other controversies, such as custody or immigration disputes.

By contrast, Congress’s authority under the taxing power is limited to requiring an individual to pay money into the Federal Treasury, no more. If a tax is properly paid, the Government has no power to compel or punish individuals subject to it. We do not make light of the severe burden that taxation—especially taxation motivated by a regulatory purpose—can impose. But imposition of a tax nonetheless leaves an individual with a lawful choice to do or not do a certain act, so long as he is willing to pay a tax levied on that choice.11

NOT SO FAST. As Roberts himself clumsily discusses in footnote 11, the Federal Government will bring its full weight to bear on the worker who refuses to pay the tax imposed for not purchasing the product in question (health insurance). It will be unlawful not to buy the health insurance and not pay the resulting tax and those who do neither will be prosecuted. Quoting:

11Of course, individuals do not have a lawful choice not to pay a tax due, and may sometimes face prosecution for failing to do so (although not for declining to make the shared responsibility payment, see 26 U. S. C. §5000A(g)(2)). But that does not show that the tax restricts the lawful choice whether to undertake or forgo the activity on which the tax is predicated. Those subject to the individual mandate may lawfully forgo health insurance and pay higher taxes, or buy health insurance and pay lower taxes. The only thing they may not lawfully do is not buy health insurance and not pay the resulting tax.

OUR CONCLUSION

With this new tax against income, as with other direct, un-apportioned taxes, one of the greatest landmarks defining the boundary between the Nation and the States of which it is composed disappears, and with it one of the bulwarks of private rights and private property.

We’ve made several arguments, based on philosophical roots and actual U.S. Supreme Court case law, that the sanctity of income as personal, private property is a foundational element of American Freedom. This current case, the Individual Mandate of Section 5000A, is a direct challenge and disregard of this vital element of our Freedom and deserves nothing less than a full, open, debate by our elected Representatives and a subsequent review by our highest Court. We will prepare a First Amendment Petition for Redress of this Grievance to be presented to both of these bodies as an appeal by Citizens for a through public airing of this aspect of our Constitutional Rights.

We question, for instance, why the majority and the dissent BOTH failed to mention the Court’s seminal 16th Amendment decision in Brushaber v Union Pacific Railroad, 240 U.S.1 (1916) in which the justices fully FULLY discussed their opinion of the constitutional meaning of “income” and direct taxes. The “third-rail” of America’s tax-honesty movement, these subjects have been avoided by the Supreme Court sinceBrushaber, notwithstanding the great divide between the Court’s interpretation of the constitutional meaning of “income,” within the four corners of the 16th Amendment and Brushaber, and the operation and enforcement of the Internal Revenue Code.

America is on a slippery slope rushing headlong into debt, dependency and decay.

It’s our (the People’s) fault. We let it happen.

If something is unconstitutional, it should not be tolerated.

The Constitution is not a menu.

The Constitution cannot defend itself.

Everybody and everything has a lobby except the Constitution and the People.

The Constitution will not be defended unless the People defend it.

Individuals and small groups cannot prevail.

The Free People of America need to institutionalize citizen vigilance.

The Free need a permanent, non-political, mass-movement – a critical mass of People working and standing together to hold all levels of government accountable to the Rule of Law, from our State and Federal Constitutions on down through our City Charters and Town Ordinances.

A mass-movement requires organization.

We the People are organizing.

Click here to view a short Power Point Presentation: WE THE PEOPLE CONGRESS – AMERICA’S FIRST NON-POLITICAL CONSTITUTION LOBBY, OF BY AND FOR THE PEOPLE, TO HOLD GOVERNMENT ACCOUNTABLE TO THE RULE OF LAW.

Click here to view a RECORDING OF A RECENT WEBINAR ON THE SUBJECT.

What’s Freedom worth?

The effectiveness of any movement depends on the size of its membership.

Join the movement. Become a member at www.givemeliberty.org

Please consider a separate donation. We are unpaid volunteers who must continue to pay a steady stream of invoices each month. Our books are open.

Please pass this article forward.

Related articles

- Originalism in the Health Care Case: What is a Direct Tax?Michael Ramsey (originalismblog.typepad.com)

- ObamaCare Lost on the Medicaid Mandate & Commerce Power, it May Yet Lose on the Tax Power (cato-at-liberty.org)

- What’s the Limit on Congress’s Power to Tax? (heritage.org)

- Recommended Reading Material From Virginia’s Attorney General (citizentom.com)

- Obamacare is an Unconstitutional Tax (dailypaul.com)

- The Tax Issue is Not Just a Technicality (volokh.com)

- Must the Court Demonstrate the Constitutionality of Its Newly Discovered Tax? – Forbes (forbes.com)

- Why Income Tax Was & Is Not Necessary To Fund the U.S. General Government. (politicalvelcraft.org)

- Does Congress have the power to tax, including Obamacare tax? (fellowshipofminds.wordpress.com)

- Could the Individual Mandate Be Unconstitutional Even As a Tax? Part 1 (onecitizenvoice.wordpress.com)