Transcript

- Rothschild Charlatan Elizabeth Warren And The Feigned Glass Steagall: Basel III Doomsday Is Upon Us.

- Dodd Frank & Basel III Enacted Treason Against The United States: Wealth Funneled Into Rothschild’s [BOE] Bank Of England.

- Breaking => Mayor Michael Bloomberg Invests $18 Million To Displace U.S. Citizen Employment In Favor Of Criminals!

- Michael Bloomberg’s Richest 1% Expatriate $21 trillion, US International Banks Expatriate $10 Trillion!

Tom Hudson: Up next, Congressman Ron Paul, from Texas.

Michele Bachmann: Hey Ron, Good luck, thank you.

Tom Hudson: Welcome, Congressman, welcome to Iowa.

Ron Paul: Thank you, it’s good to be here.

Tom Hudson:

Congressman, America sold almost 300 million dollars worth of corn to China last year, which was a 5-fold increase from the year before. Last year, American manufactures like Vermeer sold 6 billion dollars worth of farm equipment worldwide. Vermeer just signed its biggest customer deal ever yesterday, and it’s all export. How would you open up more international markets for American manufactures?

Ron Paul:

Sound’s like we’re doing pretty good, doesn’t it? Well, what you have to do is be more competitive, and we’re less competitive to be the world producer, because we have too much taxes, too much regulations. But it’s also involved with the monetary system; when a country becomes the issuer of the reserve currency of the world, unfortunately, the biggest export is money.

So there’s a temptation to buy from overseas, increase your current account deficit, and then you go to consumption. That is our disease, we’ve been doing that ever since we’ve been issuing this paper currency since 1970, and it’s gradually getting much worse. So, if you don’t look at the regulations, the taxation, trade policy, and monetary policy, this is going to continue to get much worse.

Tom Hudson:

To the point of monetary policy, Congressman Branstad mentioned a 2.5% economic growth in the third quarter, largely driven by the consumer, but also exports were strong. Exporters, like Vermeer, have been taking advantage of the weaker U.S. dollar. In fact, Vermeer says that part of the reason they were able to sign the big contract this week was because of the lower dollar, the international buyer was able to take advantage of this.

Ron Paul:

Yea, when you get a lower dollar it works for a little while, but it’s not a solution, it’s just temporary. And when you have everybody printing their money at different rates, everybody has competing devaluations. But it only lasts because we already see price inflation coming back here. So if you lower the dollar, the prices go up and it cancels out the temporary benefits. So we really have to start talking about if you want a more balanced trade and a fair trade system, you have to have a commodity standard of currency.

Otherwise you will always have these competing devaluations, and then everybody is going to be unhappy and then they’re going to ask for trade wars, we’ve already started. Look, there are tariffs being put, Brazil has put a 30% tariff on Chinese goods, so the trade wars will be devastating. So the only way you can solve that is to solve the problem of the currencies and the devaluations.

Tom Hudson:

Do you support the trade deals that were just signed with Panama, Colombia and South Korea?

Ron Paul:

I support the lowest tariffs of anybody in the Congress, I want the freest trade possible, I never vote for sanctions, I want to trade with Cuba. But, I do not like international arrangements because it’s sacrificing our sovereignty. And on occasion the WTO gives us lower tariffs, but more times than not, you go there to retaliate, and I’m not for that, I’m not for another level of government.

And, under the constitution, trade policy is to be designed by the Congress, it is not to be designed by a body that is created by Congress and give the authority to the executive branch. So no, I don’t like the international trade agreements, I just like low tariffs; as low as possible, as quickly as possible. A lot of the people who preach free trade are the first ones who put on sanctions, so they’re hypocritical about some of these free trade arrangements.

Gov. Terry Branstad:

You like low tariffs, you also like lower taxes at the federal government. The federal corporate income tax is a real burden, or I’m being told that that’s put us in a uncompetitive situation, especially with the penalty for bringing profits back from overseas. What would you do about that?

Ron Paul:

0% taxes on people who want to repatriate their money, and, as a modest start, I would put the corporate tax at 15%; we would become more competitive. I want them very low because, in many ways, they think that if you lower corporate tax, only the executive is going to benefit, but the consumer benefits too. Corporate tax is form of a sales tax, if they have to be competitive, they have to pass this on.

So I am for low taxes, but you can’t get low taxes unless you deal with the big problem, and that’s big spending. And that’s where I think so many come up short, they’re not willing to talk about significant cuts in spending.

Gov. Terry Branstad:

You’ve been really bold in that, and you want to share with us in a little more detail, because I think you’ve got the boldest plan to reduce the federal deficit. I think most Americans are scared to death, they’re seeing this country become a huge debtor nation, we’ve seen the federal debt go up 1.3, 1.4 trillion dollars year after year. We know this is not affordable, not sustainable, and you have a plan to deal with that.

Ron Paul:

Well, we have two debts, we have the foreign debt which is the biggest in the history of the world, and that’s one subject. But the national debt is now 15 trillion dollars and it’s unsustainable. And we get into a mess because of this, and everybody in Washington thinks the solution is spending more money. But the best example to realize why you have to cut spending, is what happened after World War II.

They cut spending by 60%, they cut taxes by 30%, they brought 10 million people back home, and the economy boomed. It was taken out of the government and put into the economy. No, I have a proposal to cut a trillion dollars, to cut 5 departments and significantly cut and put all that money back into the business community and into the private community.

Government expenditure just doesn’t work. But the real reason is taxes; spending is a tax. You either tax the people, you borrow the money, or you print the money, it’s always a tax. So spending has to come under control, and this idea that the economy would collapse, is absolutely false, the economy would blossom if you cut taxes and spending.

Ready? Basel III 2013 – 2019: The Dump Phase Of The Cartel’s Pyramid Scheme Begins!

Gov. Terry Branstad:

One of the problems with borrowed money is that you got to pay it back with interest, and so you can only build half as much stuff if you’re doing it with borrowed money.

Ron Paul:

And that’s a good case why individuals can’t do it, businesses can’t do it, so why should government do it? If a business gets into trouble, do we go to the businessman and say, “Well, you’re in trouble now, you’re approaching bankruptcy, what you need to do is borrow more money”.

But the government says, “To solve the problem, we have to borrow more money and stimulate the economy and help people who don’t have jobs”. Well, if the consumer drives the economy, you should be spending more money. “Get another credit card and you’ll save the economy”, it makes no sense.

Gov. Terry Branstad:

Haven’t we already tried that with this administration and the previous administration with the so-called stimulus plans? It hasn’t worked, right?

Ron Paul:

It hasn’t worked since the depression, and it didn’t work in Japan. You need to cleanse the system, you need to get rid of the mal-investment, and you need to get rid of the debt, otherwise you can’t have economic growth, and that’s what they refuse to accept.

Tom Hudson:

And just to that point, we have a question from the audience from Pat Meyer on housing, which gets to just the point about some of the things that maybe holding back the economy. Pat?

Pat Meyer:

Sir, I’m Pat Mayer, Pella Corporation. Manufactures have a considerable stake in housing and the construction industry. And, obviously, with the recent recession, it’s impacted our business. As President, what are you going to do to address the significant and rapid decline of the housing industry?

Ron Paul:

What the government needs to do is a lot less a lot sooner, and the market should have been able to adjust in 1 year, and we’d be back on our feet again. We need to get out of the mal-investment and the incentive to make mistakes; that is, when you subsidize housing interest rates like Fannie Mae and Freddie Mac, and you create too much credit, you always get a bubble.

So have to get rid of the bubble, you have to get those prices down where people will go back in and buy these houses, poor people maybe can buy a house again. But to stimulate housing or keep the government involved in giving artificially low interest rates is absolutely wrong, it will perpetuate the problem. You need to get that system where housing prices go down, and then we’ll go back to building houses again.

Tom Hudson: You talk about artificially low interest rates in housing because of government involvement in Fannie Mae and Freddie Mac, guaranteeing home loans.

The treasury department can borrow at less than 4%, and borrow that money for a decade. That’s not being withheld, that’s not being artificially held down, that’s what the market is saying it can bear. You’re a free market guy, the market is saying that interest rates ought to be low.

Ron Paul:

Yea, but it’s all artificial because the Fed is there pumping QE1, QE2. There’s nothing market-oriented with our interest rates, and that’s how you created the bubble. I mean, almost everybody in Washington now concedes Bernanke kept interest rates too low for too long.

So what was the solution? Lowering to minus. I mean, we have an inflation rate not at 3%, it’s much higher. And banks can borrow money for less than 1% interest rates.

So they’re getting negative rates, it is all artificial. Most business people know that you don’t put on wage and price control, it’s very damaging to the economy. But, generally speaking, everybody accepts this notion that the price of money is not to be left to the marketplace, it is always regulated, it has been since we’ve had this Federal Reserve, and much more so in the last 4 years.

But if you regulate the price of money, believe me, you’re going to have mal-investment, too much debt, and you’re going to have bubbles and you’re going to have a recession. And if we don’t understand the business cycle, you can’t solve the problem of a recession. That’s my contention.

Tom Hudson:

Congressman, what is short term cycle look like under a Paul Presidency if you’re able to put in place the type of monetary policies that you x, leave alone monetary policies usually in the garage of the Federal Reserve?

Ron Paul:

You have to deal with the monetary policy. if I could have my way … it took about a year after World War II, 1946, the unemployment rate was quite low, economic growth was booming. I would say a year, a year and a half. But it will be prolonged; from 2008 until now, nothing has been solved.

Tom Hudson:

But at the time of World War II, you had a growing, youthful population, you didn’t have the burden necessarily of Social Security and Medicare, and you had America as the top developed economy in the world. It’s much different in this generation.

Ron Paul:

But why? It’s because we’ve wrecked the economy. We have young people graduating from college with a trillion dollars worth of debt, and there are no jobs. So there’s a young population there begging and pleading for jobs, and that’s what we have to do. No, I wouldn’t say that the conditions are different, markets work whether you have people, no matter what the age is or what the conditions are.

On the market principle, if you cut spending and taxes and regulations, and do the right things, the jobs will become available and there’ll be people there to work. Right now I still get people looking for workers coming in, because our people aren’t trained.

So yes, we have to have workers program, a booming economy would have a requirement for more labor. But under these conditions, it’s not going to be solved, that I’m certain of.

Gov. Terry Branstad:

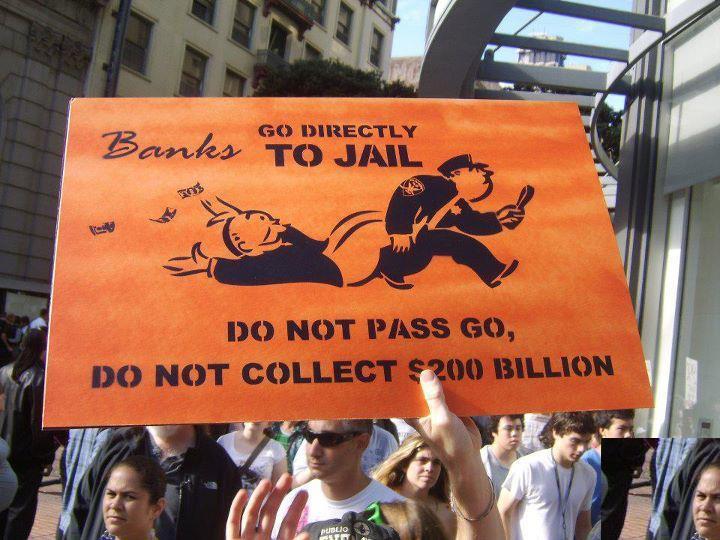

Congressman Paul, some of the young people in the Occupy Wall Street Group and whatever, are demanding that their loans be forgiven or dramatically reduced. How do you feel about that, what would that do, would that make things better or worse?

Ron Paul:

Well, it would just be more interference. It was created by the government by Sallie Mae. And they shouldn’t be given, we should give them jobs so that they can start paying that debt down. But that’s where our real problem is. But that’s a mixed bag on Wall Street, some are complaining they want more stuff handed out from the government and get out of their debt, others are there demonstrating against theFederal Reserve; I sort of like the second half.

Tom Hudson:

You’ve talked about your desire to have a more transparent monetary policy coming from the Federal Reserve. The way that the terms are situated for the Federal Reserve board governors, of course, are designed to cross over administrations and governments here in the United States. The Chairman, Ben Bernanke, is due to hold a news conference tomorrow after an interest rates meeting. What would you like to hear from the Chairman tomorrow?

Ron Paul:

He was resigning, throw in the towel, and say, “I am very sorry, Keynesian economics and price controls for money absolutely doesn’t work, and everything we’ve done in the last 4 years really hasn’t solved our problems”.

Tom Hudson: And then after the stock market explosion we’ve seen in October, what happens to capital prices?

Ron Paul: You mean after what?

Tom Hudson: After your resignation?

Ron Paul:

Well, there’s going to be steady, healthy growth, but it will be based value, it will not be based on speculation. You won’t see ‘up 300 points one day’ and ‘down 400 points the next day’, because that is not value, that is pure speculation. But you have to have a sound currency, the currency is the measure of value, and if the currency isn’t sound, this is what you have.

Prices fluctuate because it is the currency that is unsound, and internationally that is the case. We’re witnessing the destruction and the elimination and the end stages of the dollar fiat standard of the past 40 years. It’s a big event, it’s worldwide, the dollar is the reserve standard of the world, everybody holds dollars. It’s not just a United States problem, it’s a Greek problem, Spain problem, Japanese problem.

But it’s the monetary policy, that is what has created the monster that we’re dealing with today.

Gov. Terry Branstad:

The analyst are saying the stock market’s fluctuation has a lot to do with what’s going in Europe and their huge debt problem. Is it your analysis that we’re headed in that direction when you look at the debt situation in Greece and Italy and Spain and all of those European countries, is that the direction we’re headed if we don’t change directions?

Obama Shut Down Air Defense System On US/Mexico Border!

Breaking => Obama Shut Down The U.S. Air Force: 17 Front Line Defense Combat Units Grounded!

Ron Paul:

Yea, we are, and it’s going to be much bigger and much worse. But right now the dollar is still respected compared to a Euro and a Yen and people will still take it. But, the dollar is very vulnerable, the dollar bails out everybody, and it bails us out domestically.

We will be involved overseas with that European thing – they say no, but we’re in the IMF. There’s a limit to how much weight you can put on the dollar. You know, when the crisis hit in 2008, the Fed was very much involved, we did get some information: they dealt with 15 trillion dollars worth of credit.

Congress only messed around with a simple little 1 trillion dollars that they gave away to their friends. 15 trillion dollars, 5 trillion of it went to foreign central banks and foreign governments, and they didn’t want to tell us a thing, that’s why you have to have transparency.

And the American people are with me on that, because the percentage of people that want transparency of the Fed is about 68%, and I think that’s very healthy.

Tom Hudson: Congressman Paul, thank you for your comments, we appreciate it.

Ron Paul: Thank you very much.

- Ron Paul: Debt Ceiling Debate Is a Joke Date: 06/05/2011 This is a rush transcript. Can you help us out and proofread the…

- Ron Paul on the Need to Cut Spending Ron Paul explains why he favors cutting government spending rather than raising more revenue. Date:…

- Ron Paul: Allow the Correction & Stop Printing Money Transcript This is a rush transcript. Can you help us out and proofread the transcript…

States Hold Supreme Court Justices aka; Employees In Check!

- European Union Thug Scientists Rule Water Does Not Hydrate: Combine That With NWO Banker’s Leveraging Carbon As The Reason To Shut Down America’s Oil Drilling ~ Conclusion ~ Non Industrialized Carbon Units Drinking Non Hydrating Water ~ Eh?

- Take Action: SHUT DOWN Rothschild’s IMF, International Monkey Fund

Related articles:

- “I agree with Ron Paul. We are not fighting a war on terrorism. Terrorism is a tactic. We are…” (shortformblog.tumblr.com)

- Ron Paul: US Government Will Be Similar to Detroit, Gold Price Will Explode (silveristhenew.com)

- Ron Paul On Foreign Aid: We Should Stop Funding These Nations, You Can’t Buy Friendship (dailypaul.com)

- Ron Paul launches his own TV channel (newsfixnow.com)

- Why Detroit is good for gold: Ron Paul (silveristhenew.com)

- Ron Paul: Why I’m Holding My Gold – 7/23/13 (libertycrier.com)

- Guest Post: Ron Paul & Silver (silverdoctors.com)