Click to enlarge.

Forget what you are hearing about stiffer mortgage lending requirements. It’s not true. Real estate expert Fabian Calvo says,

“If you can fog up a mirror or you have a pulse, they will give you a home loan. That’s what they have done with the car loans, and that’s what they are doing with housing loans.”

The so-called new rules do not have any down payment credit score requirement. Zero percent down loans are going to make a very big comeback.

- Over 20 Million Houses Sitting Vacant.

- Looming Crash Of Rothschild Fed-Fueled Bubble Economy.

- Fed Continues Printing Money until it Implodes-Fabian Calvo

According to Calvo,

THE PUMP PHASE

OF THE BANKER’S FASCISM SCHEME KNOWN AS ROTHSCHILDISM.

“After the mid-term election, you’re going to see no-money-down loans just really roar back. It’s all part of the pump and dump I’ve been telling you about for well over a year.”

So, are the housing market problems behind us? Calvo, whose company buys and sells $100 million in distressed real estate debt annually, says,

“Bottom line is we are still in a situation where half of every mortgaged home in America is completely underwater, and the Fed is going to have to print money for a very long time before those values return. It’s just a matter of fact.”

Calvo goes on to say,

“Now, worst of all, they are beginning to securitize so they can bring in even more capital. A third of all real estate in America is rental properties. You are going to have Wall Street being the biggest landlord in America. [aka; Fascism] It’s subprime 2.0.”

- End of the Road Rush to Hard Assets-Fabian Calvo

- Gold Is 5Xs More Abundant Above Ground Than Silver!

- Mandatory 2014 Debt Forgiveness: Rothschild Federal Reserve Absconding/Transferring U.S. Precious Metals Using Artificial Gold/Silver Derivative Paper!

According to the Director of the Consumer Financial Bureau, Richard Cordray, new mortgage lending rules [Basel III] are supposed to make sure;

But Basel III Ensures The Melt Down Of U.S. Citizens: Pure Treason!! ~ Volubrjotr

“the great mortgage meltdown never happens again.”

- Save Lives: Walk Away From Fraudulent Rothschild Derivative Mortgages! Full Report

- Bail-Ins, Financial Collapse, Gold & The Great Money Bubble

- Dark Legislation ~ Dodd Frank & Basel III Enacted Treason Against The United States July 2, 2013: Wealth Funneled Into Rothschild’s [BOE] Bank Of England.

So, is the housing market more resilient to another downturn? No way, says Calvo,

“They’ve securitized the rental properties, which are now making the net effect of a collapse in values in the market much more devastating for the economy.”

This is very similar to the reasons why Rothschild’s Cabal built ghost cities with corrupt Chinese officials. They are now through this second bubble financially immigrating U.S. Citizens into these Wall Street {banker owned] owned rental housing units. Breaking => The Answer To China’s Ghost Cities: Destroying Farm Production [Agenda 21] By Forcing The Rural Chinese Into Newly Built $Consumer Based Urban Concentration Cities. Then Depopulation.

Calvo predicts,

“The next leg down in the real estate market will be much, much larger . . . Homeowners, who may have a little bit of equity in their home, should be very cautious right now.”

Still, Calvo says don’t expect a crash in 2014, and he says, “We’ll pretty much see a repeat of 2013.” Calvo says to watch when hedge funds start selling their real estate holdings. He says,

THE DUMP PHASE

OF THE BANKER’S FASCISM SCHEME KNOWN AS ROTHSCHILDISM.

The New World Order is “Communism”: Also Known As Rothschildism Or More Bluntly Robbery!

“I think that will be around 2015. That will be the handwriting on the wall that the collapse in housing prices will be coming.”

Calvo thinks the next real estate collapse will be caused by forces outside of the housing market.

Calvo says,

“I think the next leg down in the real estate market won’t be centered around the housing collapse.

It will be centered around the multi-bubble collapse of the dollar, the bonds, the government debt, all collapsing simultaneously. . . .

This next collapse will make 2008 look like a dress rehearsal for the really big multi-bubble collapse we will be seeing.”

Remember the kid working at McDonalds who was awarded $550,000 for a house loan? He could not in any way shape or form qualify for such an amount nor make the monthly payments. It didn’t matter, because as the housing bubble burst, these treacherous Rothschild operatives would reposes the home pennies on the dollar and leave a mountain of debt to the U.S. taxpayers. ~ Volubrjotr -> Read Page 4 Line 24 Lawsuit showing the corruption used by predatory loan sharks in order to utilize the bubbled market’s worthless printed paper by the Rothschild Federal Reserve.

- Why The NWO Is Devaluing The Dollar: Theft!

- Obama Was Behind Predatory Loans Of The Housing Bubble Conspiracy!

- Obama’s Secrets And Lies Of The Bailouts: Tarp Ceiling Was Secretly Raised 117 Times ~ RollingStone

- Democrats Facing Exposure In Countrywide Predatory Lending And Blocking Republican Bills To Regulate Fannie Mae And Freddie Mac in 2001-2003 & 2005 S.190

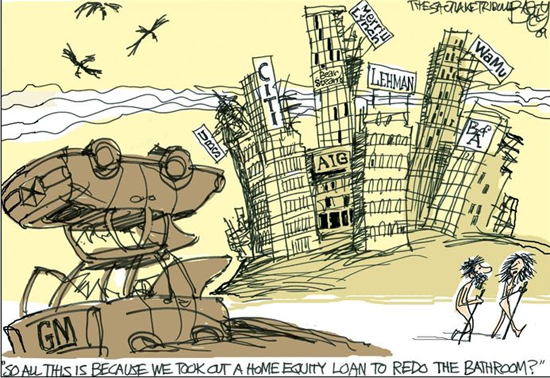

2008

So, how are the rich going to protect themselves? Calvo, who does business with millionaires and billion dollar hedge funds, says,

“A year ago, a third of the room would say buying gold and silver was just kind of crazy. Today, you have half of the room investing much more than 10 or 15% of their portfolio into physical gold and silver. To me, that is a big signal.”

Silver

Is there any good news? Yes! Calvo says,

“There’s going to be spectacular sales, spectacular deals, way more than you saw back in 2008.”

- Bitcoin & 1,000 New Merchants Per Week Utilizing New Medium Of Exchange: Bitcoin ATMs Go Mainstream!

- Mandatory 2014 Debt Forgiveness: Rothschild Federal Reserve Absconding/Transferring U.S. Precious Metals Using Artificial Gold/Silver Derivative Paper!

Join Greg Hunter as he goes One-on-One with Fabian Calvo from TheNoteHouse.us.