FORBES: The growth of government intervention over the last century was built on the back of a handful of myths.

PVC: FALSE! Its NO Myth!

FORBES: A generation ago, the dominant myth was that free markets had caused the Great Depression, a falsehood ultimately debunked by economists like Milton Friedman.

PVC: TRUE, It Was Not Free Markets aka; Capitalism, It Was Statism aka; The Corrupt Rothschild NWO Banking Cabalists!

FORBES: Today, the key myth is that financial deregulation caused the 2008 financial crisis.

PVC: FALSE! Its No Myth. Billy Clinton put the nail in the coffin by deregulating Rothschild Banks, by repealling The Glass Steagall Act!

FORBES: What deregulation?

PVC: The 1999 Repeal Of The Glass Steagall Act By Billy Clinton! This completely deregulated/unleashed the 1% in allowing them to abscond the wealth of the Sovereign Citizens Of The United States.

FORBES: There aren’t many possibilities. Despite what we hear, regulation of the financial industry substantially increased over the last thirty years.

PVC: Out right falsification! With the deregulation of the banks by the democratic party, they were further deregulated by The Dodd/Frank Act.

- Dodd-Frank Act Perpetuates Jimbo Carter’s Failed Department Of Energy Fiasco Of 1977!

- America’s Debt Is Smoke And Mirrors: Dodd/Frank Most Culpable In Fraudulent Paper Scam!

- Impeach Barney Frank & Chris Dodd – But they have now conveniently left their offices.

- Barney Frank And Christopher Dodd What They Did To Set Up America For Centralizing Tax Payer’s Money!

- What’s The Matter With Remembering Chris Dodd?

- Had Christopher Dodd Supported GOP Regulations In 2001, 2003, 2005 – Housing Bubble Would Not Have Happened – Including Goldman Sachs!

- Banker’s Hedge Funders Bilk The Same Money In One Hour From Americans ~ As It Takes For A Modest Middle-Class-American Family To Work For In Over 47 Years!

- States Need To Fire The America Bashing Federal Government & Forgive The Debt: Rothschild Federal Reserve Has Quintupled Since Obama!

- Dodd (d-conn) Hides Out In Ireland On A Real Estate Bonanza, That He Does Not Know How Much He Paid For!

FORBES: Government spending on financial regulations, to take one measure, ballooned from $725 million in 1980 to $2.07 billion in 2007 (in 2000 dollars). Anyone looking to blame deregulation for the crisis faces slim pickings.

PVC: FALSE! No slim pickings here!

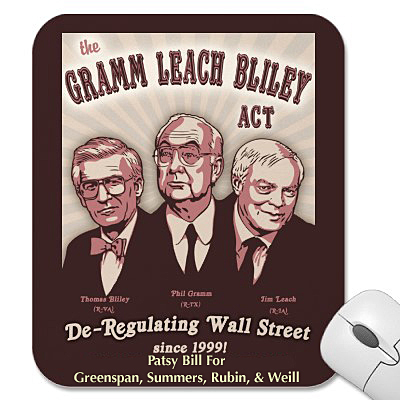

FORBES: By far, the single most cited example of this financial “deregulation” is the Gramm-Leach-Bliley Act (GLB), which partially repealed the Glass-Steagall Act thirteen years ago today. Regulatory evangelists including Nobel Prize economist Joseph Stiglitz and recent senatorial candidate Elizabeth Warren, not to mention the Occupy Wall Street protesters, have named the overthrow of Glass-Steagall as public enemy number one.

FORBES: Stiglitz, for instance, in a lengthy piece for Vanity Fair, could only muster two examples of the deregulation he thinks bears primary responsibility for the crisis: the repeal of Glass-Steagall and the SEC’s 2004 decision to raise banks’ debt-to-capital ratio from 12:1 to 30:1. The latter, of course was not deregulation, but re-regulation. For the regulatory evangelists, the repeal of Glass-Steagall is all they’ve got—and what they’ve got ain’t much.

PVC: FALSE! How in the hell can deregulating from a 12:1 all the way out to a 30:1 not be a deregulation of the 12:1? They increased the ball park diamond for the bankers by 2 1/2 Xs. Also, whats this “evangelist shlop”?

FORBES: Glass-Steagall was enacted in 1933 to create a firewall between commercial and investment banks: commercial banks could not underwrite or deal in securities, and investment banks could not accept deposits. The Act also restricted commercial banks from being affiliated with any company that underwrote or dealt in securities.

But by the 1990s, the affiliation provision was widely viewed as unnecessary and even harmful to financial institutions. In 1999, President Clinton signed GLB into law. Although it left the bulk of Glass-Steagall in place, it ended the affiliation restrictions, freeing up holding companies to own both commercial and investment banks.

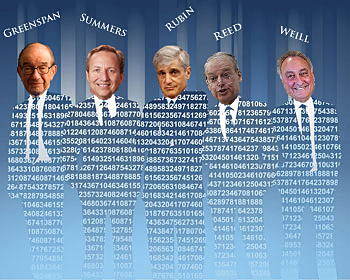

PVC: TRUE! If you want to believe in the likes of Greenspan, Summers, Rubin, Reed, & Weill.

The Elites Responsible For Orchestrating The Destruction Of The Glass Steagall Act Of 1933 Are As Follows:

- Goldman Sachs:

- Alan Greenspan

- Rothschild Federal Reserve:

- Alan Greenspan

- Larry Summers

- Citibank:

- Sandy Weill

- John Reed

- Robert Rubin

- Traveller’s Insurance:

FORBES: There is zero evidence this change unleashed the financial crisis. If you tally the institutions that ran into severe problems in 2008-09, the list includes Bear Stearns, Lehman Brothers, AIG, Merrill Lynch, and Fannie Mae and Freddie Mac, none of which would have come under Glass-Steagall’s restrictions. Even President Obama has recently acknowledged that “there is not evidence that having Glass-Steagall in place would somehow change the dynamic.”

PVC: FALSE! ALL OF THE ABOVE MENTIONED BANKS WERE TIED INEXTRICABLY TO THE U.S. MORTGAGE MARKET ALL OF WHICH WERE REGULATED BY THE GLASS STEAGALL ACT BY SEPARATING COMMERCIAL FROM INVESTMENT!

While there were a number of provisions in the Glass Steagall Act, the most critical for the financial stability of the United States was the section which prevented commercial banks (eg., Wells Fargo, Citibank, Bank of America, etc) from merging with insurance aka; investment banks (eg., Goldman Sachs, Lehman Brothers, Morgan Stanley, etc).

Why? Because before Glass-Stegall, an investment bank could use the savings and checking deposits of customers at commercial banks to make investments. This gave investment banks access to a balloon of money, which allowed for making investments with Other People’s Money (OPM). This activity led to the collapse of the banks in 1929, when millions of Americans lost their savings which they had in commercial banks.

The Glass-Steagall Act of 1933, was {financial regulatory legislation} which was enacted as a response to the financial collapse of 1929 and it kept America safe from financial disaster for 72 years. It only took 7 years after deregulation in 1999, for the 1% to send America back into into a financial disaster!

- Bear Stearns’ Overexposure to Mortgages and Dishonesty About Its Exposure Made the Investment Bank Vulnerable. Taxpayers Burden With $30 Billion USD Bailout. Bear Stearns Was Bought Out By J.P. Morgan. {A} NWO Banking Cabal Attempt To Close THE TRAP: Morgan Stanley Faces Imminent Shutdown ~ Orchestrated Fallout -> 1st Private Stock Account Thefts! {B} OhOh ~ JPMorgan Chase Libor Scheme: Subpoenas Coming From All Over The World. {C} Three LIBOR Rigging Rothschild Bankers Have Now Been Arrested ~ HSBC Will Not Be Prosecuted By Obama For Money Laundering ~ Too Big To Jail.

- Lehman Brothers’ Extensive Use of Leverage and Significant Mortgage-Related Security Holdings Led to Problems with Short Sellers and a Crisis of Investor Confidence. Lehman Brothers Triggered The AIG Bailout, Which Eventually Grew To A $60 Billion USD Burden For The American Citizen.

- Lack of Internal Oversight at AIG and Lack of Comprehensive Regulation of the Insurance Industry Made the Insurance Giant Vulnerable to Collapse. Taxpayers Burden Was Initially A $35 Billion USD Bailout!

- Merrill Lynch an investment bank was purchased by Bank of America a commercial bank! Merrill Lynch focuses on retail brokerage.

- Government Sponsored Enterprises like Fannie Mae and Freddie Mac are not mortgage lenders themselves, but instead buy mortgages from private banks.

Since the 1980s Greenspan, Summers, Rubin, Reed, & Weill were doing everything they could to remove the regulations between commercial and investment banks (insurance companies) that the Glass-Steagall Act of 1933 had made law. In fact, In 1998, Citigroup bank (a commercial bank) purchased Travelers Group (High Risk Insurance Company) and they broke the law in violation of the Glass-Steagall Act.

Citigroup received from tax payers a bailout for $306 Billion {of course in newly printed money} that we must work off in one form or another!!! Why didn’t Forbes mention this? Lets not forget Citigroup had previously received from us taxpayers $25 billion in exchange for preferred shares on which they were supposed to pay 5% interest for five years and then 9%. But people were running out of jobs and couldn’t pay so Citigroup laid off about 50,000 of its employees, or 20% of its global workforce. Not a bad scheme for indebting the United States eh?

Now back to the other banks as well. During the 1999 House debate to repeal The Glass-Steagall Act, they argued that the repeal would result in banks being “too big to fail,” and would require the government to have to bail them out. Well Just Look Where we are now!!!!! Forbes: “zero evidence” comment appears to have “zero credibility”. In fact, it was mentioned by a Democrat who wanted the Regulation to stay in place, his name is Rep. John Dingall, D-Michigan!

FORBES: As for the FDIC-insured commercial banks that ran into trouble, the record is also clear: what got them into trouble were not activities restricted by Glass-Steagall. Their problems arose from investments in residential mortgages and residential mortgage-backed securities—investments they had always been free to engage in.

PVC: FALSE! Forbes Directly Admits commercial banks got in trouble because of deregulation between commercial and investment securities. They were not always free to engage in and with investment banks, they were all Inextricably bound by the same matrix of loading up in debt, bailing out on the back of taxpayers, and then merging into each other through buy-outs ~ artificially giving and orchestrating a scenario for Rothschild’s Federal Reserve To Print Money Into Oblivion And Thus Destroying The Strength Of The American Republic. Rothschild Foams At The Mouth In His Dreams Of Destroying This Nation As It Is The One Nation That Could End His Corrupt Looting Of Nation States!! It Appears Now, That Russia Will Be The One To Put Rothschild Out Of Business! Lets Hope The United States Wakes Up To All This Chicanery To Help Russia End Rothschild.

The record is clear, The Federal reserve PUMPED the banking matrix up into the $trillion beginning in 2006. Fed Reserve Chairman Ben Bernanke was issuing BACK DOOR bailouts to the big banksters! This process fed the newly printed money into The U.S. system. Through fraudulent bailouts, the banks would pay back the loans of {fiat currency} printed by Bernake – thus diluting the value of the U.S. Dollar! – Now This Printed Fiat Money Was ‘Legitimized’ To Be On The Books And A Burden For The U.S. Citizen To Now Work Into The Future To Give It Pegged Value. To Peg It To A Value , Only The Secret Non-Transparent Rothschild Fed Reserve Would Know. So in a nutshell, The U.S. Was/Is Being Diluted Into OBLIVION!

FORBES: GLB didn’t cause the financial crisis—and, when push comes to shove, the regulatory evangelists must admit as much.

PVC: FALSE! The Glass Steagall Act Protected The U.S. Citizens From The Rothschild Ilk & Prevented Financial Disasters For 72 Years! GLB Within 7 Years Caused The Largest Financial Disaster In U.S. History! The deregulatory Apologists must admit as much__eh?

FORBES: Stiglitz, in the same Vanity Fair article, concedes that Glass-Steagall did nothing to “directly” cause the crisis. Warren, meanwhile, confessed to New York Times reporter Andrew Ross Sorkin that Glass-Steagall would probably not have stopped the financial crisis, but that she was pushing to reinstate it because, in Sorkin’s words, “it is an easy issue for the public to understand and ‘you can build public attention behind.’”

PVC: FALSE!! And This Is The Best One!! The ONLY thing that could have stopped the financial crisis Was Not The Glass Steagall Itself, But The Enforcement Of The Glass Steagall Act!! Its already been shown that Bernake Broke The Law {Pumping Money Into The Commercial/Investment Matrix} And Citigroup Broke The Law, by mingling with an investment bank {Traveller’s Insurance}. So Nobel Prize Winner Joseph Stiglitz and Elizabeth Warren are ‘spot on’. NYT’s spin by Sorkin is a tortured spin and actually laughable!

FORBES: The reason deregulation is blamed for the crisis is not because there’s proof that GLB was responsible. It’s because people like Stiglitz and Warren have an ideologically based suspicion of markets and the self-interest they unleash.

PVC: FALSE! The NWO/Democrats {Greenspan, Summers, Rubin, Reed, & Weill} deregulation of the banking system, is abjectly self evident, that NOW there is NOTHING on the books to enforce, against the Pump/Dump back door absconding of U.S. Citizen’s money. GLB GUTTED the regulations of The Glass Steagall Act & The Volker Rule/Dodd Frank Bill Is An Absolute Joke!

The Dodd/Frank Histrionics were a simple choreographed stunt of 2,300 pages for the public to think something was being done to protect them! NOTHING COULD BE FURTHER FROM THE TRUTH!!!

FORBES: You can think of it as the “greed” explanation: bankers and financiers are not selfless “public servants,” but “greedy” profit-seekers out for themselves. Unless carefully controlled and limited by government regulators, the story goes, this “greed” is inevitably a destructive force that will foster short-range and often predatory decisions.

“Predatory lending practices in the subprime mortgage space contributed to the mortgage crisis, yes, but it was just one of many factors all along the transaction chain, running from borrowers who heard what they wanted to hear, to originators extending credit without documentation of income (even to illegal immigrants), to banks purchasing loans with no intention of serving them, all the way to Fannie and Freddie and the investment banks. According to Michael Lewis, a long-time financial journalist and author of “The Big Bet and Liar’s Poker”: “The corruption of lending standards in the subprime market, the corruption of the ratings agencies, which gave triple-A ratings to bonds which never should have been rated. The investment banks, which had historically been the smart money at the table, became the dumb money at the table!” Real Estate

Is it any wonder that those who held this view did not feel the need to investigate what led to the financial crisis, but “just knew” the answer had to be a lack of government control? “Wall Street has betrayed us,” John McCain declared just one day after Lehman’s collapse. “This is a result of excess and greed and corruption. . . . And we got [sic] to fix it and we’ve got to update our regulatory system.”

If one understood that the pursuit of profit in a free market does not favor a short-term, cut-every-corner mentality, one’s approach would be very different. One would consider real the possibility that government interference with market forces led to the irrationality and value-destruction of the financial crisis. Indeed, that’s precisely what a growing body of literature suggests.

The definitive history of the financial crisis remains to be written. But one thing is for sure: it shouldn’t be written by those who have a quasi-religious conviction that the freedom to pursue profits is the cause of all the world’s problems, and that government regulation is the unfailing elixir.

PVC: It sounds like Forbes Is Suggesting An Ideologically Based “Old West Nirvana” Where There Is No Law And Order. This Does Appear As An Ideological Rant, Especially After The Banking Cabalists Have Stolen & Hoarded The Wealth Of The United States. If Law & Order Is Quasi Religious In Their Precepts, I suggest That They Are Still Only Half Way There In Truly Understanding Law & Order!

Related articles

- How The Too Big To Fail Banks Were Born: Reinstate The Glass Steagall Act! (politicalvelcraft.org)

- Glass Steagall Repeal Made Crisis Worse (ritholtz.com)

- Former Reagan Treasury Secretary James Baker: Supports Reinstating Glass-Steagall To Stop Rothschild Banking Cabal! (politicalvelcraft.org)

- Glass Steagall Repeal Made Crisis Worse (ritholtz.com)

- Wall Street Executive Salaries Skyrocketed After Deregulation (thinkprogress.org)

- Something Odd Happened To Wall Street Salaries After 1987 (businessinsider.com)

- Obama’s Defense of Dodd-Frank Falls Short (news.firedoglake.com)

- Warren takes aim at ‘too big to fail’: Reinstating Glass-Steagall a ‘top three’ priority (rawstory.com)