By Komal Sri-Kumar

What do the following have in common: the tax imposed on Cypriot bank deposits last month, a Portuguese court’s annulment of some of the government’s austerity measures, and the recent political stand-off in Italy?

They all suggest the European crisis is far from over despite the calm brought to financial markets by European Central Bank President Mario Draghi’s promise last summer to buy unlimited amounts of the debt-ridden countries’ obligations.

- Obama’s U.S. Austerity In Motion: Genocide Of 50 Million American Citizens Coming Our Way!

- 9/11 Completely Unmasked: Black 9/11~ Money, Motive, Technology, & Deniability!

There is a sense of foreboding in the region. The risk of a flight of bank deposits to safer countries has risen, and sharp economic contractions extended to Germany and France in the final quarter of 2012. The European Commission anticipates that regional unemployment will continue to rise and reach a record 11 per cent in 2014.

Fortunately, these dark clouds come with a silver lining. More governments are recognising that the current system of bailouts accompanied by austerity dooms the economies to perpetual recession and worsens debt ratios. While smaller countries such as Greece or Portugal lack the leverage to force an alternative solution, the prospect of a long recession in Spain and Italy could be a game changer.

The eurozone’s economic recovery can come only with a reduction in the level of debt and debt service, allowing the freed resources to boost domestic output and employment. Italian voters rejected former Prime Minister Mario Monti’s adherence to austerity in elections held in February. The new prime minister Enrico Letta has already demanded less austerity rather than accept belt-tightening measures as Greece, Ireland and Portugal have done.

Due to Italy’s size – it is the third largest eurozone economy, and its €2tn public debt is the largest in the EU – it is my pick for the country that will force a fundamental shift in policies. Concessions to Italy, and subsequently, to other countries, are highly probable after the German elections scheduled for September.

- How Freemasonry United Italy Against The Freemason’s Ancient New World Order: Freemasonry Was Ended By Fascism And Fascism Was Ended By “We The People!

- European Union’s Childlike Refusal To Acknowledge Reality: Italy Is Large Enough To End The E.U. Ponzi Scheme!

- Bilderberg Mafia Calls Emergency Meeting In Rome, Italy ~ Facebook Purges: On The Tail Of Italy Supreme Court Submission Of U.S. 9/11 Crimes To The International Criminal Tribunal!

- Italy To Help American Citizens: President Of Italy’s Supreme Court Sends U.S. 9/11 Crimes To International Criminal Tribunal!

- Stopping The Banking Cabal: Italy’s Mobilization For Glass-Steagall To Be Introduced In The House Of Delegates!

- FYI Italy Calls France, United States, & Britain To Immediately Halt Libya War: Italy Blocks Use Of Their Airbases By NATO. Now Rothschild Puts The Screws To Italy!

- FYI German People Awaken To The EU Scam: Remember When Italy Awoke? The Police Became The People!

- I Day Before Boston Bomb & Texas Missile Attack: CIA, Bill Clinton, George Bush Jr., & Barack Obama Indicted By Congressional “Constitutional Task Force” For Crimes Against Humanity!

Spain is likely to demand concessions similar to those Italy will receive. House prices have dropped more than 30 per cent since 2007 according to the Spanish national statistics agency, and are expected to keep falling in 2013 and 2014. Spain cannot revive its economy, or improve debt ratios, without concessions from its creditors.

A second reason for the likely shift in policy is a byproduct of Europe’s poor handling of the Cyprus situation last month. Massive losses imposed on deposits over €100,000, and restrictions on withdrawals and capital transfers by small depositors, put eurozone savers on notice that they may have to pay for some of the bailouts.

Would you keep your deposits in Milan or Madrid rather than in Munich if you were not compensated for the risk? Flight of deposits could dramatically increase the need for funds, and accelerate the search for an alternative solution.

What would the shift in EU debt policy mean for financial markets? A potential diminution in the level of debt, or of reduced interest payments, would suggest that French, Italian and Spanish bonds are richly valued today. Why would you buy 10-year Italian paper with a coupon of 5.5 per cent for €1,115 today if a bank may soon be prepared to sell you the same paper for €950?

Another implication is that the obverse of debt reduction would be losses in lender portfolios, and an increase in the banks’ need for capital. While lenders will contest the writedowns, the political imperative to revive growth is likely to be the major determinant for policy makers.

There will be benefits for investors. First, recognition of loan losses will result in higher yields on European sovereign and corporate debt. This will attract new capital from hedge funds and private equity funds, with positive implications for growth and employment.

- Heads Up For May 11th Or 5:11: The NWO Gang Bangers Really Enjoy Subliminals!

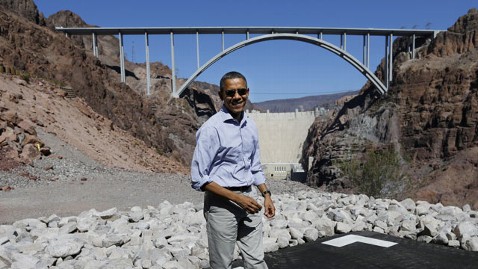

- Hoover Dam The Next 9/11? You Decide!

Second, expect the restructured debt to be issued with new collateral, such as a backing of German Bunds, to reassure lenders that they will not have to take additional losses. This should enhance the debt’s credit quality.Third, as Slovenia’s new Prime Minister Alenka Bratusek has emphasised, the “stability programme” she will present next month to address the country’s debt crisis will include a sale of state-owned companies. Expect Slovenia’s example to be followed elsewhere in the eurozone. By buying equity in countries on the verge of a turnround, investors can expect attractive returns.In sum, I expect austerity fatigue in Europe after more than three years of belt-tightening to lead to measures resulting in assets such as bonds, equities and privatised companies trading at more realistic valuations. That is an essential precursor to attract new funds, and for growth to revive.Komal Sri-Kumar is president of Sri-Kumar Global Strategies

ON THIS TOPIC

- Hollande condemns anti-German attacks

- Austerians are taking on the Spendanigans

- Analysis Austerity is hurting – but is it working?

- Spain plans to delay deficit reduction

MARKETS INSIGHT

- Bank of Japan action threatens emerging Asia

- Markets Insight Global banking and regulation already fractured

- Misuse of collateral creates systemic risk

- How Abenomics benefits Japanese companies

Related articles

- The Austerity Delusion (3quarksdaily.com)

- Shooting overshadows Italy cabinet (bigpondnews.com)

- The era of austerity is over (for now) (washingtonpost.com)

- Italy needs Churchillian leader to fight ‘war damage’ of EU austerity (telegraph.co.uk)

- Divisions deepen as tide turns against Eurozone austerity (gulfnews.com)

- Two shot as Italy’s new PM sworn in (abc.net.au)

- Eurozone Debt Levels Reach Record High – Eurostat (ibtimes.co.uk)

- Too Much Austerity in E.U. (sparkingtheleft.com)

- Eurozone: The cycle of deficits, debts and austerity revisited (europeansting.com)