- 100 years of physical silver price suppression

- Physical silver inventories gone

- Physical silver stockpiles cannibalized

- Global physical silver mining industry destroyed

- Now the re-pricing of physical silver begins

The price for real, physical silver is currently Decoupling from the artificial paper price for silver.

What does this mean? Why should you care, as an investor?

What it means is that the world’s most heavily suppressed commodity market is about to be liberated from its price manipulation for the first time in 100 years.

That’s a big deal.

For investors, it’s a chance to participate in the most radical (permanent) re-pricing of a commodity in the history of commodity markets.

That’s a big opportunity.

Let’s start at the beginning.

The True Price of silver

Humanity has been mining and refining gold and silver for nearly 5,000 years. For over 4,000 years, the approximate gold/silver price ratio has been 15:1.

The two metals exist (in the Earth’s crust) at a ratio of ~17:1. This means for over 4,000 years humanity has had a slight preference for silver over gold – relative to supply.

This is not surprising, for two reasons.

- Silver is a more aesthetically brilliant metal than gold

- Silver exists at an ideal scarcity to make it perfect as the Peoples’ Money

Today, the gold/silver price ratio is ~70:1. It has recently soared to extremes of over 100:1. We’re told by the media (and pseudo “silver experts”) that this is because silver is now “an industrial metal”.

This is patently ludicrous.

Silver is still a more beautiful precious metal than gold. It is still used as money by billions of people around the world. But as the world’s most versatile metal, it also has countless industrial applications.

This additional usefulness (and demand) can only make silver even more valuable – not less valuable. In other words, in any rational market for silver, the gold/silver price ratio would be less than 15:1.

Reinforcing this point, the above-ground supply ratio for gold and silver is closer to 1:1. This reflects the fact that most of the world’s silver stockpiles (accumulated over 4,000+ years) have been cannibalized and literally consumed.

Only 8 ounces of silver are produced for every 1 ounce of gold in today’s world. This is because there aren’t really any good naturally occurring silver deposits left in the world. The Burning Platform This site makes an argument to by SLV which is a paper product. The Many Dangers Of Owning SLV a paper product.~ Volubrjotr

Most of the world’s above-ground silver today is spread around the world’s landfills, in concentrations too low for any of it to be recovered (unless/until the price of silver reaches a rational level).

With the price of gold currently at $1830/oz, a minimum rational price for silver today would be >$120/oz.

Given the current above-ground supply ratio of these metals (and the historical preference for silver over gold), a compelling argument can be made that the price of silver should be >$1,000/oz today.

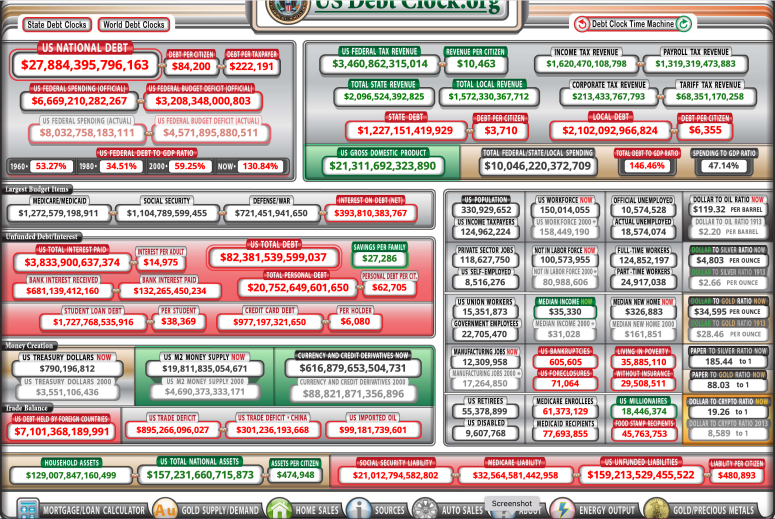

However based upon the artificial debt load and the massive manipulation by JP Morgan and several other banks the REAL actual price of physical silver today should be $4,803 per ounce to dollar ratio. Gold is 8Xs higher based upon production of gold to silver ratio $34,595 per ounce. These prices are real time per US Debt Clock February 7, 2021. See Below Chart Right Side Edge. ~ Volubrjotr

A century of artificial silver prices

Roughly 100 years ago, we saw the first “decoupling” in the silver market. For the first time in history, the price of silver was no longer priced at a rational level relative to gold.

Since that time, the price of silver has been suppressed – and not allowed to reach its fair market value.

The evidence of this price-suppression is all around us.

Destruction of silver stockpiles

No one has studied the global supply of silver more than noted silver authority, Ted Butler. Butler estimated (over a decade ago) that roughly 90% of the world’s stockpiles of silver – accumulated over more than 4,000 years – had been cannibalized and consumed in industrial applications.

From a stockpile of ~10 billion ounces at the end of World War II, Butler estimated (in 2004) that only 1 billion ounces remained. He went even further at that time suggesting that the above-ground supply of gold now exceeded the supply of silver.

In a world that has always preferred silver to gold (relative to supply), if the supply of silver is less than the price of gold, shouldn’t its price be higher (i.e. >$1,800/oz)?

600-year low for price of silver (in real dollars)

Beginning in the late 1980s, the price suppression of silver (by the Western banking cartel) reached new extremes. In real dollars, the price of silver was pushed to a 600-year low. The real-dollar price for silver has moved only fractionally since then.

Destruction of the global silver mining industry

With the price of silver at a 600-year low, over 90% of the world’s silver miners were driven into bankruptcy. For the first time in over 4,000 years, most of the world’s silver has come as a byproduct of other mining.

Roughly 70% of the global silver supply (today) comes from such secondary mining. The fact that the price of silver will no longer even support a (primary) silver mining industry is the most-obvious proof that the price of silver has been extremely suppressed – to grossly irrational levels.

The world is running out of silver

Thanks to silver price suppression, we no longer have an adequate supply of silver. The global silver market has been in a permanent supply deficit for over 30 years. Between 1990 and 2005 alone, global silver inventories collapsed by 90%.

Thanks to silver price suppression, we no longer have abundant stockpiles of silver.

As precious metals, gold and silver have (historically) been conserved by humanity. The gold is still conserved. The silver is gone.

To summarize the current state of the silver market:

- Permanent supply deficit

- Stockpiles gone

- Silver currently priced at only a small fraction of what is needed to restore market balance

Silver price “decoupling”

The “official” price for silver in the global silver market is currently ~$26.50 per ounce. But this is a paper price. It is the (heavily manipulated) price at which the bankers trade paper ‘silver instruments’, paper called “silver”.

In official testimony to the CFTC, self-described precious metals expert Jeffrey Christian stated that only 1% of the trading in the gold market was actual metal.

All the rest was trading in paper-called-gold. Experienced silver traders strongly believe the silver market is even more heavily leveraged (falsified) with paper-called-silver.

A totally artificial market. The bankers can create infinite quantities of this paper-called-silver with a mouse-click.

Real silver has to be mined out of the ground. There is a significant, real-world cost to that.

Obviously, the price for silver, the world’s most-useful metal, has to be more than what it costs to mine silver out of the ground.

In the bankers’ fantasy market for paper-called-silver this minimum fair-market price for silver is never, ever mentioned. The bankers simply pretend that real silver can also be conjured into existence with nothing more than a mouse-click.

Now, after 100 years of price suppression, with global silver stockpiles gone, the silver market has begun to re-price itself – in a manner that is totally out of the control of the banking cartel.

Decoupling.

There are now two prices for silver.

– One (legitimate) real price for actual metal: the price that people must pay to buy (real) silver directly.

While the phony artificial price for silver is currently $26.50/oz, real silver costs anywhere from $35.50 to $39/oz at official dealers – if you can find it. And even more to purchase in private sales.

(Both do not reflect the REAL current value of PHYSICAL silver, it does show that in this suppressed market, retail dealers are now parting ways with the derivative paper pricing – a type of arbitrage a type of Robinhood manuever. Shorts continue in SLV and the Comex and the retail purchases are discouraged by seemingly higher prices. Fact is, that both prices are astronomically disconnected from physical silver’s REAL value vs US Debt Clock ~ Volubrjotr)

Related News:

- The gold/silver question

- States Begin Eliminating Tax On Gold & Silver Money

- The Dollar Is Coming Home To Die: Dumped By The World

- PHYSICAL SILVER 5XS RARER ABOVE GROUND THAN PHYSICAL GOLD!

- TEXAS SHIFTS AWAY FROM THE FEDERAL RESERVE: STATE’S NEW SILVER GOLD BULLION DEPOSITORY

- ALABAMA SENATE UNANIMOUSLY PASSES BILL TO EXEMPT GOLD AND SILVER FROM TAXATION: CONSTITUTIONAL MONEY

-

SLV is heavily manipulated and the ‘ounces’ of silver they claim to have to back their investors is not confirmed. The custodian of this Trust is JPMorgan, who in September of last year was literally fined $920 Million for ‘spoofing’ precious metals futures markets and US treasuries. Don’t get in financial bed with crooks in charge of your money.

*To consider, not financial advice: Step 1: We buy out the physical (their lifeline) Step 2: We buy call options/long stocks on promising miners i.e. $AG, $FSM, etc. ($PSLV may be worthy too, they’re 3rd party audited) Step 3: The market is now cornered. They can’t bullshit us and say they’re buying physical to back the paper numbers being reported. Step 4: We meme our way through the squeeze (HOLD) Step 5: There’s no flash crash following our efforts, because silver truly deserves a much higher valuation.

ABSOLUTELY TOPS ARTICLE!! Well said, thank you, thank you, thank you!

LikeLike

Hello – What do you feel about Physical Silver ETFs such as SIVR ? It’s cost per share closely tracts with the reported price for silver per troy oz. Why is such investments not increasing in value as the stock market in general drops now? Thank you. bobtroendly@rm4sinc.com

LikeLike

Real money (silver/gold) being suppressed by fiat paper contracts at the Comex. Why? To retain the populace in fiat products.

This masquerade is coming to an end and is accelerated by Russia selling their oil strictly by gold/ruble. This process is diminishing the ability to continue fiat paper contracts.

ETFs are again physical reduced to paper they are not a currency. ETFs can fractionalize silver meaning many can hold claim to just 1 ounce. It’s fiat alchemy.

LikeLike